What is Buy Now, Pay Later? BNPL for short is known as installment payments and point-of-sale financing (POSF). Offering buyers credit as part of a purchase has been around since antiquity and therefore, what we are seeing is an explosion of a new variant. The improvements include greater flexibility and longer payment terms, instant KYC and underwriting, all embedded at the checkout.

Managed correctly, BNPL provides an opportunity to open the purchase funnel, expanding the ways in which consumers can complete transactions which can also be a cost effective way of accessing credit. In recent times, partnerships (not acquisitions) with BNPL companies have increased significantly. What Buy Now, Pay Later does offer is a route for accelerating customer acquisition, which businesses with a wide array of products can monetise through bundled payment pricing. Examples are Amazon and Affirm, Stripe and Klarna.

Let’s use Klarna as an example who are a standalone BNPL provider. As a part of a value chain and to maximize the value of the BNPL market, they rely strongly on integration within a selling proposition that in turn, relies heavily on marketing – marketing that can influence the consumers’ likelihood to buy.

Marketing tactics

As mentioned above, the BNPL and payments overall, are an element of the marketing mix for marketers to leverage. Here are some examples:

- Buy Now, Pay Later is spreading beyond apparel and general retail and in turn, BNPL providers are now becoming masters of the customers’ journey. They are aiming higher with very little being off limits – home improvements and medical procedures being prime examples. What was once not affordable or burdened with high interest payments, now becomes a comfortable way to pay.

- BNPL makes sales that wouldn’t have been made if a one-off payment was necessary.

- The BNPL provider is likely to advertise on behalf of the sales company – a boost to promotions, offers and products that the merchant is looking to promote. In this instance, Klarna is used again as an example, where they list hundreds of stores for buyers to browse through and under their ‘business’ section, cater to businesses in order to offer promotional messaging and an option to offer various payment options to their buyers.

Buy now, pay later (BNPL) providers can offer small- and medium-sized businesses (SMBs) much more than the ability to offer installment payment plans. They also can help merchants draw customers to their organization in the first place and close sales that may not have happened otherwise.

The e-commerce platforms where BNPL proliferates provide large networks and significant data that the BNPL fintechs harness.

Big Data

For now, the majority of BNPL purchases are made with either a debit or a credit card. Using income and payment data from users’ bank accounts (most BNPL customers link these product purchases to debit cards), successful BNPL companies demonstrate that these new methods of determining credit worthiness work. Banks already have the customer data, the technology and the ability to offer at competitive prices. However, the key is to move quickly in order to build enough merchant partnerships to compete and as mentioned earlier, BNPLs already have this in place.

Consumers shopping and buying behaviours are captured by Buy Now, Pay Later providers. This means that there is direct access to data and analytics – types of customers, spending powers, purchasing trends, prioritizing supply chains, demographics and so on. In turn, making BNPL providers ideal partners – the best point of entry in the sales funnel.

Some banks have now moved into the BNPL space. Because the bank has a clear history of the customers' behaviour and transactions, the pay-later option has evolved beyond that of only online purchases with merchants, into one of ‘entire financial life’. Examples are, Citigroup (Citi Flex Pay), JP Morgan Chase & Co (My Chase Plan), as well as companies that include neobanks.

The popularity of Buy Now Pay Later

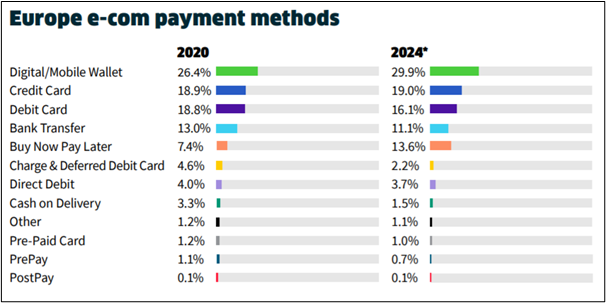

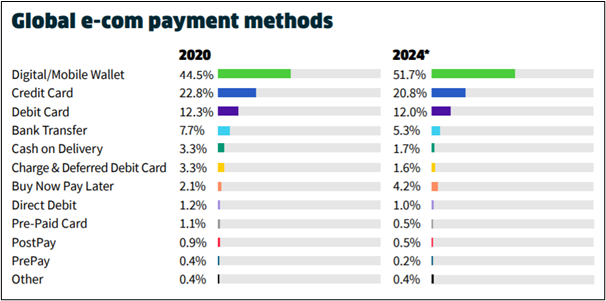

Looking ahead to 2024, the popularity of BNPL will make some of the largest gains out of all payment methods *nearly doubling its share by 2024 to account for 13.6% of e-com spend. Advances by digital wallets and BNPL options will come at the expense of more traditional payment methods, with charge cards, cash on delivery and pre-paid services seeing steady declines through 2024.

* worldpay The Global Payments Report 2021

Payment Options – a ‘switch on’ BNPL feature

To meet growing demand for flexibility, mainstream banks are striving for a slice of the action and have introduced digital-first payment options – an installments program enabling customers to choose how and when they pay from a brand they trust. Mastercard Installments is one such offering. Others include Revolut, Affirm, LayBuy and Monzo (POSF) where the customer is able to ‘split’ transactions into smaller installment amounts at the point of purchase.

Debit Card take-off

Debit card usage, whether physical or through digital services such as Apple Pay that are connected to a card has continued to grow. In the UK, debit card spending in May this year was up 18% year on year and 9% higher that the same month in 2019*

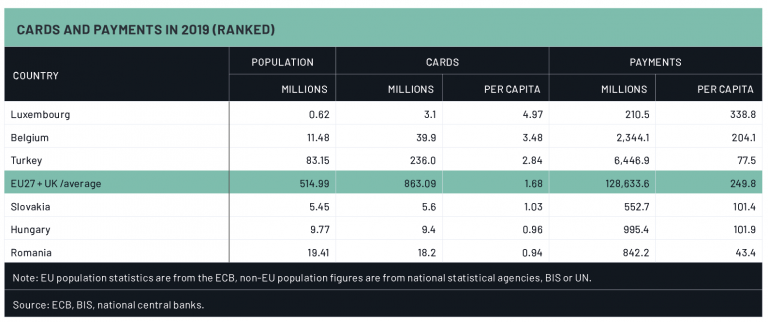

Debit cards now account for 68.8 percent of all cards issued in Europe, with compound growth in the number of debit cards at 4.25 percent over the last five years. Debit cards outstrip credit cards by a ratio of 2.21 to 1, up from 1.81 to 1 five years ago. While this is part of a longer-term shift away from credit cards, the usage of debit cards shows how pervasive they now are. Debit card payments were up 11.80 percent across Europe to 76.11 billion, with spending on debit cards growing at a compound rate of 13.17 percent over the last five years – more than twice the rate at which debit cards have been issued – demonstrating the popularity of the debit function.

- Payments Industry Intelligence

*UK Finance

How does a Hardware Security Module (HSM) protect payment data?

A payment HSM is a secure, tamper-resistant cryptographic processor designed specifically to protect the lifecycle of cryptographic keys and to execute encryption and decryption routines. It provides a high level of security in terms of confidentiality, integrity, and availability of cryptographic keys and any sensitive data processed. The payment industry, banks and financial services rely of payment HSMs to secure a number of functions:

- Verifying user-entered PIN against reference PIN held by card issuer

- Verifying debit/credit card transactions by conducting host processing duties for EMV-based transactions or checking CSVs

- Supporting a crypto-API with an EMV

- Re-encrypting a PIN block to be sent to another authorization host

- Performing secure key management

- Supporting POS ATM network management protocol

- Supporting host-host key/data exchange API standards

- Generation and printing of “PIN mailer”

- Generating PVV and CVV data for magnetic stripe cards

- Generating a card keyset and supporting the smart card personalization process

Conclusion

Payment HSMs are critical to protect card transactions but are expensive to purchase and complex to manage. For your specific needs, a cloud-based, fully managed service could be a more efficient way of using Payment HSMs.

MYHSM is currently operating in over 36 countries globally and is part of Utimaco’s IT security solution. As the first multi-vendor service provider offering two of the world’s leading HSM manufacturers: the Atalla AT1000 and Thales payShield 10K, MYHSM’s mission is to be the global go-to provider of Payment HSMs as a Service, by delivering the benefits of reduced capex and complexity without compromising on the highest security and service standards.

Blog post by Dawn Illing.